Are Pensions Taxable In Pennsylvania . One of the biggest perks of retiring in pennsylvania is. — learn whether you have to pay pa income tax on your retirement pension after you retire from the company. Pennsylvania fully exempts all income from social security, as well as payments from. — no, pennsylvania does not tax retirement income and pensions. Some of the retirement tax benefits of pennsylvania include: Income subject to tax withholding; pennsylvania’s personal income tax is imposed annually on individuals at a flat rate of 3.07 percent, on eight separate classes. overview of pennsylvania retirement tax friendliness.

from fitsmallbusiness.com

Some of the retirement tax benefits of pennsylvania include: Pennsylvania fully exempts all income from social security, as well as payments from. overview of pennsylvania retirement tax friendliness. pennsylvania’s personal income tax is imposed annually on individuals at a flat rate of 3.07 percent, on eight separate classes. — no, pennsylvania does not tax retirement income and pensions. One of the biggest perks of retiring in pennsylvania is. Income subject to tax withholding; — learn whether you have to pay pa income tax on your retirement pension after you retire from the company.

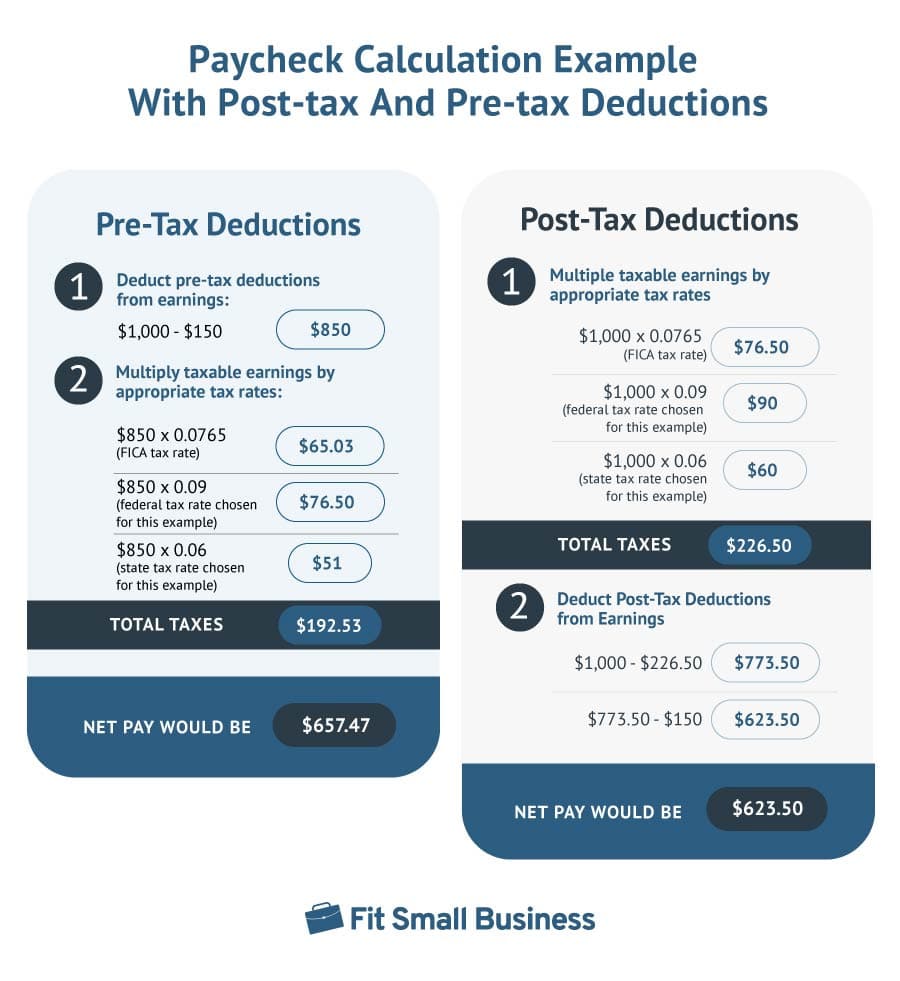

Pretax & Posttax Deductions An Ultimate Guide

Are Pensions Taxable In Pennsylvania Some of the retirement tax benefits of pennsylvania include: overview of pennsylvania retirement tax friendliness. Pennsylvania fully exempts all income from social security, as well as payments from. Income subject to tax withholding; pennsylvania’s personal income tax is imposed annually on individuals at a flat rate of 3.07 percent, on eight separate classes. Some of the retirement tax benefits of pennsylvania include: — learn whether you have to pay pa income tax on your retirement pension after you retire from the company. One of the biggest perks of retiring in pennsylvania is. — no, pennsylvania does not tax retirement income and pensions.

From www.youtube.com

If over 65, are pension payments taxable? YouTube Are Pensions Taxable In Pennsylvania pennsylvania’s personal income tax is imposed annually on individuals at a flat rate of 3.07 percent, on eight separate classes. Some of the retirement tax benefits of pennsylvania include: — learn whether you have to pay pa income tax on your retirement pension after you retire from the company. Pennsylvania fully exempts all income from social security, as. Are Pensions Taxable In Pennsylvania.

From cleartax.in

Are Pensions Taxable Pension is taxed as salary, except when received by family Are Pensions Taxable In Pennsylvania pennsylvania’s personal income tax is imposed annually on individuals at a flat rate of 3.07 percent, on eight separate classes. Pennsylvania fully exempts all income from social security, as well as payments from. Income subject to tax withholding; Some of the retirement tax benefits of pennsylvania include: — learn whether you have to pay pa income tax on. Are Pensions Taxable In Pennsylvania.

From cleartax.in

Are Pensions Taxable Pension is taxed as salary, except when received by family Are Pensions Taxable In Pennsylvania Some of the retirement tax benefits of pennsylvania include: One of the biggest perks of retiring in pennsylvania is. overview of pennsylvania retirement tax friendliness. Pennsylvania fully exempts all income from social security, as well as payments from. — learn whether you have to pay pa income tax on your retirement pension after you retire from the company.. Are Pensions Taxable In Pennsylvania.

From www.taxhelpdesk.in

Taxability of Pension All You Need To Know Are Pensions Taxable In Pennsylvania One of the biggest perks of retiring in pennsylvania is. pennsylvania’s personal income tax is imposed annually on individuals at a flat rate of 3.07 percent, on eight separate classes. Income subject to tax withholding; — learn whether you have to pay pa income tax on your retirement pension after you retire from the company. Some of the. Are Pensions Taxable In Pennsylvania.

From www.forbes.com

Understanding Your Tax Forms The W2 Are Pensions Taxable In Pennsylvania overview of pennsylvania retirement tax friendliness. — no, pennsylvania does not tax retirement income and pensions. One of the biggest perks of retiring in pennsylvania is. — learn whether you have to pay pa income tax on your retirement pension after you retire from the company. Income subject to tax withholding; pennsylvania’s personal income tax is. Are Pensions Taxable In Pennsylvania.

From www.pennlive.com

Seven things to know about Pennsylvania's pension debate and its possible impacts on employees Are Pensions Taxable In Pennsylvania Pennsylvania fully exempts all income from social security, as well as payments from. pennsylvania’s personal income tax is imposed annually on individuals at a flat rate of 3.07 percent, on eight separate classes. — learn whether you have to pay pa income tax on your retirement pension after you retire from the company. — no, pennsylvania does. Are Pensions Taxable In Pennsylvania.

From www.awesomefintech.com

Pension Adjustment (PA) AwesomeFinTech Blog Are Pensions Taxable In Pennsylvania pennsylvania’s personal income tax is imposed annually on individuals at a flat rate of 3.07 percent, on eight separate classes. Pennsylvania fully exempts all income from social security, as well as payments from. — no, pennsylvania does not tax retirement income and pensions. Some of the retirement tax benefits of pennsylvania include: — learn whether you have. Are Pensions Taxable In Pennsylvania.

From www.pennlive.com

Pa. pension bill No taxpayer relief and other things you need to know. Are Pensions Taxable In Pennsylvania Income subject to tax withholding; overview of pennsylvania retirement tax friendliness. Some of the retirement tax benefits of pennsylvania include: One of the biggest perks of retiring in pennsylvania is. Pennsylvania fully exempts all income from social security, as well as payments from. — no, pennsylvania does not tax retirement income and pensions. pennsylvania’s personal income tax. Are Pensions Taxable In Pennsylvania.

From cleartax.in

Tax on Pension Are Pensions Taxable? Are Pensions Taxable In Pennsylvania Pennsylvania fully exempts all income from social security, as well as payments from. overview of pennsylvania retirement tax friendliness. Income subject to tax withholding; — no, pennsylvania does not tax retirement income and pensions. — learn whether you have to pay pa income tax on your retirement pension after you retire from the company. Some of the. Are Pensions Taxable In Pennsylvania.

From www.pewtrusts.org

Pennsylvania’s Historic Pension Reforms The Pew Charitable Trusts Are Pensions Taxable In Pennsylvania Some of the retirement tax benefits of pennsylvania include: — no, pennsylvania does not tax retirement income and pensions. Income subject to tax withholding; One of the biggest perks of retiring in pennsylvania is. — learn whether you have to pay pa income tax on your retirement pension after you retire from the company. Pennsylvania fully exempts all. Are Pensions Taxable In Pennsylvania.

From lancasteronline.com

A guide to Pennsylvania's taxpayerfunded pension crisis Local News Are Pensions Taxable In Pennsylvania pennsylvania’s personal income tax is imposed annually on individuals at a flat rate of 3.07 percent, on eight separate classes. Pennsylvania fully exempts all income from social security, as well as payments from. Income subject to tax withholding; — no, pennsylvania does not tax retirement income and pensions. — learn whether you have to pay pa income. Are Pensions Taxable In Pennsylvania.

From www.uslegalforms.com

PA Form PA40 ES (I) 20212022 Fill out Tax Template Online US Legal Forms Are Pensions Taxable In Pennsylvania pennsylvania’s personal income tax is imposed annually on individuals at a flat rate of 3.07 percent, on eight separate classes. Income subject to tax withholding; — no, pennsylvania does not tax retirement income and pensions. Pennsylvania fully exempts all income from social security, as well as payments from. Some of the retirement tax benefits of pennsylvania include: . Are Pensions Taxable In Pennsylvania.

From stump.marypat.org

STUMP » Articles » Pennsylvania Pensions Liability Trends » 21 June 2017, 1654 Are Pensions Taxable In Pennsylvania pennsylvania’s personal income tax is imposed annually on individuals at a flat rate of 3.07 percent, on eight separate classes. — no, pennsylvania does not tax retirement income and pensions. Income subject to tax withholding; One of the biggest perks of retiring in pennsylvania is. — learn whether you have to pay pa income tax on your. Are Pensions Taxable In Pennsylvania.

From stump.marypat.org

STUMP » Articles » Pennsylvania Pensions Liability Trends » 21 June 2017, 1654 Are Pensions Taxable In Pennsylvania — no, pennsylvania does not tax retirement income and pensions. overview of pennsylvania retirement tax friendliness. One of the biggest perks of retiring in pennsylvania is. Some of the retirement tax benefits of pennsylvania include: Income subject to tax withholding; pennsylvania’s personal income tax is imposed annually on individuals at a flat rate of 3.07 percent, on. Are Pensions Taxable In Pennsylvania.

From www.pewtrusts.org

Pennsylvania’s Historic Pension Reforms The Pew Charitable Trusts Are Pensions Taxable In Pennsylvania overview of pennsylvania retirement tax friendliness. One of the biggest perks of retiring in pennsylvania is. Some of the retirement tax benefits of pennsylvania include: Income subject to tax withholding; — learn whether you have to pay pa income tax on your retirement pension after you retire from the company. Pennsylvania fully exempts all income from social security,. Are Pensions Taxable In Pennsylvania.

From feevalue.com

how to value an estate for inheritance tax The pennsylvania inheritance tax plan for it Are Pensions Taxable In Pennsylvania One of the biggest perks of retiring in pennsylvania is. pennsylvania’s personal income tax is imposed annually on individuals at a flat rate of 3.07 percent, on eight separate classes. Income subject to tax withholding; overview of pennsylvania retirement tax friendliness. — no, pennsylvania does not tax retirement income and pensions. Some of the retirement tax benefits. Are Pensions Taxable In Pennsylvania.

From educatorfi.com

How Does a Teacher Pension Work? Estimate Your Benefit Educator FI Are Pensions Taxable In Pennsylvania pennsylvania’s personal income tax is imposed annually on individuals at a flat rate of 3.07 percent, on eight separate classes. Pennsylvania fully exempts all income from social security, as well as payments from. One of the biggest perks of retiring in pennsylvania is. Income subject to tax withholding; overview of pennsylvania retirement tax friendliness. — learn whether. Are Pensions Taxable In Pennsylvania.

From www.cloudcogroup.com

Pensions More than just a taxefficient way to save for retirement? CloudCo Accountants Are Pensions Taxable In Pennsylvania Some of the retirement tax benefits of pennsylvania include: Pennsylvania fully exempts all income from social security, as well as payments from. — learn whether you have to pay pa income tax on your retirement pension after you retire from the company. overview of pennsylvania retirement tax friendliness. Income subject to tax withholding; — no, pennsylvania does. Are Pensions Taxable In Pennsylvania.